Welcome to FIMMAC 2024, where we gather under the marquee of “Innovate and Invest” to explore the transformative power of innovations and their impact on industrial adaptation post-pandemic and beyond. This year’s theme highlights the essential role of emerging technologies in driving high efficiency, ensuring better transparency, and leveraging greater intelligence in our industry.

Join us as we delve into discussions on how innovations are reshaping our world, enhancing business practices, and strengthening operational capabilities. This convention is a unique opportunity to connect with thought leaders, industry experts, and like-minded professionals dedicated to pushing the boundaries of innovation and investment.

Do not miss out on this chance to be at the forefront of industry transformation. Mark your calendars for 12 September 2024, and join us at FIMMAC 2024 for a day of inspiration, innovation, and investment in the future.

Why Attend?

Listen and engage

with industry experts

Enrich your knowledge

by learning from industry leaders

Receive first-hand

industry outlook

Test your knowledge

on the basics of investing

Learn about

URS/PRS from Distributors

Find out more on how to be a UTS/PRS Consultant

For Consultants to

be effective and relevant through upskilling

For Consultants to

keep abreast with the latest updates

Knowledge sharing sessions with industry experts

Promote awareness

on financial literacy

Networking

and engagement

Programme

Thursday, 12 September 2024

8:00 AM

Arrival & Registration

9:00 AM

Opening Address

By Mohd Ridzal Mohd Sheriff, Chairman, FIMM

9:20 AM

Keynote Address

By Salmah Bee Mohd Mydin, Executive Director, Market Development, Securities Commission Malaysia

9:40 AM

Session 1

UT Industry Market Outlook

Moderator:

Tan Lee Hock, Founding Editor & Publisher, Asia Asset Management

Speakers:

- Kaleon Leong, Chief Executive Officer, FIMM

- Mohd Zhafry Zainol, Deputy Director, Economics Department, Bank Negara Malaysia

- Yu Junqiang, Acting Head of Equity, Hong Leong Asset Management Berhad (HLAM)

Content

- CGT/FSI tax exemption implications on Unit Trust

- Performance of underlying

instruments

Learning Outcomes

- Impact on investors and fund houses

10:40 AM

Coffee Break

11:00 AM

Session 2

Digitalisation in the Asset Management Industry

Moderator:

Kuek Ser Kuang Zhe, Editor of Wealth, The Edge

Speakers:

- Muzzaffar Othman, Chief Executive Officer & Executive Director, Amanah Saham Nasional Berhad

- Dennis Tan, Managing Director, iFAST Capital Sdn Bhd

Content

- Impact of digitalistion in the fund management industry

Learning Outcomes

- Greater efficiency in acquiring and retaining new business

- What this means for Consultants and investors

12:05 PM

Session 3

Investment: It’s An Opportunity, Not A Guarantee!

Moderator:

Datin Yon See Ting, Director, FIMM

Speakers:

- Long Shih Rome, Chief Economist, Public Mutual Berhad

- Mohd Najman Md Isa, Chief Executive Officer & Chief Investment Officer, RHB Islamic International Asset Management Berhad

- Mohd Redza Abdul Rahman, Former Head, PNB Research Institute Sdn Bhd

Content

- Identifying investment opportunities and risks

Learning Outcomes

- Making good and practical investment decisions

1:05 PM

Lunch and Networking

2:05 PM

Session 4

Clarity Through Noise

Moderator:

Dato’ Shamsuddin Mohd Mahayidin, Director, FIMM

Speakers:

- Jawahar Ali, General Manager, Consumer & Investor Office, Securities Commission Malaysia

- Yap Siok Hoon, Chief Executive Officer, Eastspring Investments Berhad

- Ch’ng Cheng Siew, Chief Investment Officer, Areca Capital Sdn Bhd

- Nirmala M Supramaniam, Head of Household Financial Education Department, Credit Counselling and Debt Management Agency (AKPK)

Content

- Understanding market noise and its impact

- Sources of noise and market behaviour

- Scam awareness

Learning Outcomes

- How to navigate through the noise to achieve investment goals

3:10 PM

Session 5

Enhancing Professionalism in Investment Advisory

Moderator:

Jas Bir Kaur, Director, FIMM

Speakers:

- Linnet Lee, Director, Resolute Planning Sdn Bhd

- Reuben van Dijk, Director, Melbourne Capital Group Sdn Bhd

- Alvin Tan, Executive Director & Chief Executive Officer, UOB KayHian Wealth Advisors

Content

- Building blocks of a strong foundation

- Reinforcing fundamentals of investment advisory

Learning Outcomes

- Enhance client relationship skills

- Fostering investor confidence

4:10 PM

Coffee Break

4:30 PM

Session 6

Retirement Ready? Never Too Early

Moderator:

Professor Joseph Cherian, Deputy Chief Executive Officer and Practice Professor of Finance, Asia School of Business

Speakers:

- Datuk Wira Ismitz Matthew De Alwis, Executive Director & Chief Executive Officer, Kenanga Investors Berhad

- Amardeep Kaur, General Manager & Head of Investment Management Development, Securities Commission Malaysia

- Rajen Devadason, CFP, Licensed Financial Planner

- Balqais Yusoff, Head of Strategy Management, Employees Provident Fund

- Peter Yong, Co-founder and Chief Executive Officer, Mr Money TV

Content

- Importance of retirement planning

- Retirement planning strategies and avoiding decision mistakes

Learning Outcomes

- Identifying efforts for a comfortable retirement

5:40 PM

Games

5:50 PM

Closing Remarks

By Kaleon Leong, Chief Executive Officer, FIMM

6:00 PM

End of FIMMAC 2024

FIMMAC 2024 Speakers

Mohd Ridzal Mohd Sheriff

Chairman,

Federation of Investment Managers Malaysia (FIMM)

Salmah Bee Mohd Mydin

Executive Director of Market Development,

Securities Commission Malaysia

Datin Yon See Ting

Director,

Federation of Investment Managers Malaysia (FIMM)

Jas Bir Kaur

Director,

Federation of Investment Managers Malaysia (FIMM)

Dato Shamsuddin Mohd Mahayidin

Director,

Federation of Investment Managers Malaysia (FIMM)

Muzzaffar Othman

Chief Executive Officer &

Executive Director,

Amanah Saham Nasional Berhad (ASNB)

Datuk Wira Ismitz Matthew De Alwis

Executive Director/

Chief Executive Officer,

Kenanga Investors Berhad

Kaleon Leong

Chief Executive Officer,

Federation of Investment Managers Malaysia (FIMM)

Dennis Tan

Managing Director,

iFAST Malaysia Sdn Bhd

Mohd Najman Md Isa

RHB Islamic International Asset Management Bhd

Alvin Tan

Chief Executive Officer,

UOB KayHian Wealth Advisors

Yap Siok Hoon

Chief Executive Officer,

Eastspring Investments Malaysia

Ch’ng Cheng Siew

Chief Investment Officer,

Areca Capital Sdn Bhd

Long Shih Rome

Chief Economist,

Public Mutual Berhad

Reuben van Dijk

Director,

Melbourne Capital Group

Amardeep Kaur

General Manager and Head of Investment Management Development Department,

Securities Commission Malaysia

Jawahar Ali Ameer Ali

General Manager,

Securities Commission Malaysia

Mohd Zhafry Zainol

Deputy Director of the Economics Department,

Bank Negara Malaysia

Balqais Yusoff

Head, Policy and Strategy Department,

Employees Provident Fund

Nirmala Supramaniam

Education Department,

AKPK

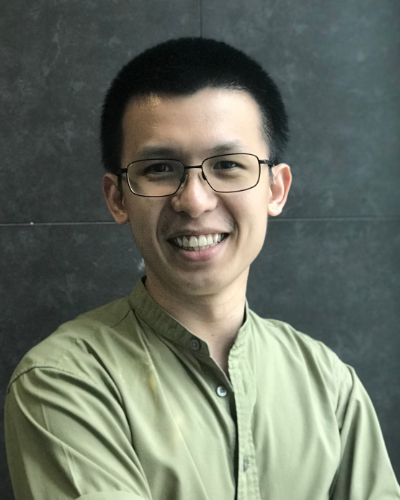

Yu Junqiang

Acting Head of Equity,

Hong Leong Asset Management Bhd (HLAM)

Mohd Redza Rahman

Former Head,

PNB Research Institute (PNBRI)

Tan Lee Hock

Founding Editor and Publisher,

Asia Asset Management (AAM)

Professor Joseph Cherian

Deputy CEO & Practice Professor,

Finance Asia School of Business

Linnet Lee, CFPCERT TM, IFP®

Chief Executive Officer,

Resolute Planning

Kuek Ser Kwang Zhe

Editor of Wealth,

The Edge

Rajen Devadason

CFP Licensed Financial Planner

The Venue

Address:

Grand Summit Ballroom, Level M1,

The Vertical,

59200 Kuala Lumpur,

Federal Territory of Kuala Lumpur

https://maps.app.goo.gl/UJYn5sT2LoPCp34d8?g_st=it

Valet Parking Guide:

Visitor Parking Guide:

Venue Guide (from parking):

Mohd Redza Rahman

Former Head,

PNB Research Institute (PNBRI)

Mohd Redza is the former Head of PNB Research Institute (PNBRI), which focuses on providing solutions and recommendations for structural and long-term opportunities for the PNB ecosystem and the nation. Prior to this, he was the Head of Investment Analysis at PNB.

Mohd Redza started his career as a test engineer in a semiconductor company before switching into the financial services industry. He has served in sell-side and buy-side equities research roles at MIDF Investment Bank, Khazanah Nasional and ValueCAP, and in an equity market regulatory role at Bursa Malaysia.

He graduated with a BSc in Electrical Engineering from Columbia University in the City of New York and an MBA from Universiti Malaya.

Salmah Bee Mohd Mydin

Executive Director of Market Development,

Securities Commission Malaysia

Salmah Bee Mohd Mydin is the Executive Director of Market Development at the Securities Commission Malaysia (SC) responsible for policy formulation in the areas of sustainability, corporate governance, investment product development along with the securities and derivatives development.

An important focus of the SC’s agenda is the development of a capital market that is inclusive and sustainable and Salmah leads a team that is responsible for formulating initiatives to enhance market efficiency, vibrancy and competitiveness. Salmah’s previous experiences within regulatory function include investigation, supervision and authorisation.

Jawahar Ali Ameer Ali

General Manager,

Secutities Commission Malaysia

Currently attached with the Consumer & Investor Office, Securities Commission Malaysia (“SC”) as the Head of Department. He has been in the SC in various capacities for the past 23 years. Prior to that, he was an Advocate & Solicitor of the High Court of Malaya for 3 years. Jawahar holds a Bachelor of Laws LL.B. (Hons) from the International Islamic University.

Dr. Wong Huei Ching

Executive Director of Digital Strategy and Innovation,

Securities Commission Malaysia

Dr. Wong Huei Ching is the Executive Director of Digital Strategy and Innovation at the Securities Commission Malaysia (SC). She currently oversees the development and innovation for digital markets as well as the SC’s technology and analytics capabilities.

Huei Ching joined the SC in 2017 and has been involved in strategic planning and market development, focusing on alternative fundraising, market vibrancy and industry digitalisation. She was instrumental in the development of the SC’s Capital Market Masterplan (2021-2025) and represented the SC as a board member of the Labuan Financial Services Authority (2020 to 2023).

Prior to joining the Commission, she was with a global management consulting firm and one of Malaysia’s largest banks. She has over 17 years of experience, largely in financial services.

Huei Ching holds a Bachelor’s in Electronic and Communications Engineering and a PhD in Electrical and Electronic Engineering from the University of Bristol, UK.

Alvin Tan

Chief Executive Officer,

UOB KayHian Wealth Advisors

Alvin is the Executive Director and Chief Executive Officer of UOB KayHian Wealth Advisors, a 100%-owned subsidiary and wealth management distribution division of UOB KayHian (M) Securities.

He is instrumental in charting the company strategic direction and enhancing the productivity of the company by reinforcing positive culture through vision and value statements.

Under his current leadership, the company has developed UWealth, an in-house proprietary investment platform that provides wealth advisors and clients, an end-to-end multi-investment assets execution and administration digital platform.

As of 31st Dec 2023, the company is currently advising Rm2.1 billion of Assets Under Advice (AUA) and with a strong network of 330 wealth advisors nationwide.

Alvin started his investment career with TA Unit Trusts Bhd as their Senior Agency Manager, where he is awarded as the Top Newcomer and Most Promising Consultant Year 2002.

He has over 20 years of financial services industry experience and is currently the President of Financial Planning of Malaysia (FPAM) for the year 2023 to 2025.

Graduated top from his class, he holds a first class honours degree in Finance from Universiti Tenaga Nasional Malaysia, majoring in investment and risk management.

Mohd Zhafry Zainol

Deputy Director of the Economics Department,

Bank Negara Malaysia

Mohd Zhafry is currently the Deputy Director of the Economics Department at Bank Negara Malaysia. He read economics at University Putra Malaysia and has a Master of International and Development Economics from the Australian National University.

In a career spanning over 17 years at the Bank, he undertakes research and analysis focusing primarily on households and businesses in the Malaysian economy. He has also been actively involved in various policy advisory work at the national level, which includes to enhance Malaysia’s framework to attract and realise quality investment and outlining strategies to develop Malaysia’s services sector.

Yu Junqiang

Acting Head of Equity,

Hong Leong Asset Management Bhd (HLAM)

Mr. Yu Junqiang is the Acting Head of Equity with Hong Leong Asset Management Berhad (HLAM). He joined HLAM in July 2014.

He began his career as an equity research analyst for both local and regional markets.

Mr. Yu has more than 10 years of experience covering Malaysia, South East Asia, Hong Kong, China and global markets. He obtained his Capital Markets Services Representative’s License from the SC since 8 April 2016.

Currently, he is managing seven funds: HL Hong Kong Equity Optimizer, HL SEA 5 Equity Fund, HL Global ESG Fund, HL Asia Pacific Dividend Fund, HL Asia Pacific Equity Fund, HL Global Multi Strategies Fund & HL PRS Asia Pacific Fund

Nirmala Supramaniam

Head Household Financial Education Department,

AKPK

Nirmala Supramaniam completed her Bachelor of Economics (Hons) degree at Universiti Kebangsaan Malaysia followed by Masters in Managements Science from Universiti Utara Malaysia. Additionally, she holds a Registered Financial Planner (Associate) certificate. Nirmala has also embarked her journey into coaching and has completed her Diploma in Ontological Coaching with TheCoach Partnership, Singapore. Her career began in a commercial bank within the Credit Card Department, where she played a pivotal role in establishing the Shared Services Department for streamlining administrative tasks and eventually took charge of this unit. In 2009, Nirmala transitioned to AKPK, where she served as a Credit Counselor, primarily offering guidance and counseling to individuals facing financial distress. She also engaged in negotiations with Financial Institutions to facilitate fair settlements that aligned with applicants’ financial capabilities.

Later, Nirmala Supramaniam joined the Financial Education Department at AKPK and was entrusted with overseeing community outreach programs aimed at promoting AKPK’s Financial Education initiatives. She actively collaborated with various NGOs and community organizations as SMART partners to extend these programs to the community. Her role also included being the Deputy Chairperson of the Financial Education Working Group (FEWG), where she contributed to the enhancement and relevance of the current Financial Education Programs, specifically tailored to the needs of the target consumer group and addressing key areas of vulnerability.

Subsequently, Nirmala assumed the position of Head of Module Development within the Financial Education Department. In this role, she was responsible for creating pertinent training materials related to financial education, conducting trainer training sessions, and preparing staff for media appearances. She participated in numerous media interviews to emphasize the significance of Financial Education and engaged in forum discussions.

Presently, Nirmala Supramaniam holds the position of Head of the Household Financial Education Department, where she oversees the outreach and development of financial education initiatives targeted at households.

Tan Lee Hock

Founding Editor and Publisher,

Asia Asset Management (AAM)

Tan Lee Hock is the Founding Editor and Publisher of Asia Asset Management (‘AAM’), a monthly journal on investments and pensions which was launched in Hong Kong in 1995.

He has more than four decades of experience covering the Asian financial markets, and a passion for promoting investor education via AAM’s Annual Roundtables.

He hosts the ‘Best of the Best’ Awards annually, recognising investment excellence and leadership across the Asia-Pacific region.

Amardeep Kaur

General Manager and Head of Investment Management Development Department,

Securities Commission Malaysia

Amardeep Kaur is presently a General Manager and Head of Investment Management Development Department at the Securities Commission Malaysia (SC). She is responsible for managing and leading policy formulation as well as facilitating the developmental initiatives for fund management and advisory landscape. This includes its various investment products and covers private markets ecosystem as it relates to venture capital and private equity industry.

Amardeep has been with the SC since 2004. Prior to working at the SC, she worked in various capacities in Bursa Malaysia group of companies from 1998 to June 2004.

Amardeep graduated with a LL.B (Law) from University of Leicester, United Kingdom, in 1996 and LL.M (Corporate and Securities Law) from London School of Economics, United Kingdom, in 2007. She obtained a Certificate of Legal Practise (CLP) from the University of Malaya and admitted to the High Court of Malaya.

Amardeep is a recipient of the British Chevening Scholarship awarded by the British High Commission.

Dennis Tan

Managing Director,

iFAST Malaysia Sdn Bhd.

With over 10 years of experience in the funds industry, oversees the Group’s business in Malaysia. Mr Tan joined the Group in 2002 as an IT Manager and was involved in the development of end-user portfolio and investment software tools and applications for B2B customers. In 2004, he took on the position of Business Development Manager responsible for the growth of the software division business.

In 2006, Mr Tan was promoted to Managing Director of iFAST Service Centre Sdn Bhd and in 2008, he took on the role of Managing Director of iFAST Malaysia. Prior to joining the Group, he was a software engineer with a software house. Mr Tan is a Computer Science graduate from University Putra Malaysia and is a Certified Financial Planner.

Dato Shamsuddin Mohd Mahayidin

Director,

Federation of Investment Managers Malaysia (FIMM)

Dato’ Shamsuddin Mohd Mahayidin was appointed as the Public Interest Director of Federation of Investment Managers Malaysia (FIMM) in September 2023.

Previously, he served at Bank Negara Malaysia for 38 years before retiring in March 2023. During this time, he was involved in various roles including those relating to the development of the financial market, international financial cooperation, policy formulation and investment operations. He has extensive experience in strategic management of support service operations, organisational governance, risk management relating to operational support services, procurement and sourcing strategy, process improvement, organisational transformation and change management.

Dato’ Shamsuddin was also previously an Adjunct Professor at University Malaysia Kelantan and served on the Advisory Panel for its Master’s Degree Programme in Islamic Finance at the Faculty of Entrepreneurship and Business.

He is currently an Independent Non-Executive Director and member of Risk Committee at OCBC (Malaysia) Berhad and Independent Director, member of Audit and Risk Committee, Nomination and Remuneration Committee, Investment Committee and Chairman of Tender Committee at Perbadanan Nasional Berhad (PERNAS). He holds Adjunct Professorships at Taylor’s University, DRB-Hicom University of Automotive Malaysia and University Putra Malaysia.

Dato’ Shamsuddin holds a Bachelor’s degree in Business Administration (Management System) from Lakehead University, Canada and a Master’s degree in Business Administration from Manchester Business School, United Kingdom.

Jas Bir Kaur

Director,

Federation of Investment Managers Malaysia (FIMM)

Having spent her entire career within the financial services/capital markets industry, Jas Bir Kaur (“Jas Bir”) brings with her a wealth of knowledge and understanding about the regulatory framework of Malaysia’s capital markets. She has been involved in many areas of industry oversight, including supervision, product development, and the formulation of policies for the industry, particularly in relation to investment management and stockbroking.

Jas Bir started her career in 1980 with Bank Negara Malaysia (BNM), following the completion of her undergraduate studies as a BNM scholar. After six (6) years, she was then seconded to the Ministry of Finance (MOF) for seven (7) years where she was part of the Capital Issues Committee, the body then responsible for the consideration and approval of all funds raising of securities by public companies. Whilst working for MOF, Jas Bir was also involved with the initiative to establish the Securities Commission (SC), the organisation which is now the regulator of Malaysia’s capital markets.

When the SC was established in 1993, Jas Bir continued her career there, rising to the position of Deputy Director. Her responsibilities while working for the SC included overseeing the growth and development of Malaysia’s managed fund industry, including developing and updating industry policies and guidelines. Jas Bir left the SC in 2018 after 25 years of service.

In addition to her experiences with BNM, MOF, and SC, Jas Bir had also worked for Prudential Fund Management (now known as Eastspring Investments Berhad; on secondment from the SC) and for Value Partners Group Limited in Hong Kong. Both experiences broadened her industry expertise to also encompass the asset management point of view.

Jas Bir holds a Masters in Finance from Strathclyde University in Glasgow, Scotland as well as a Masters in Managerial Psychology from HELP University College, Kuala Lumpur. She is also a member of Securities Industry Dispute Resolution Center (SIDREC) Panel of Mediators.

Datin Yon See Ting

Director,

Federation of Investment Managers Malaysia (FIMM)

See Ting is a partner of Christopher & Lee Ong, a member of Rajah & Tann Asia. She has more than 30 years of experience as a corporate and competition lawyer in Malaysia, in advisory as well as in transactional work. Her practice areas include Mergers & Acquisitions, Corporate Commercial and Competition Law where she is focused on M&As, joint ventures, Takeovers and competition law. Her competition law experience extends from acting in dawn raids and investigations (including for cartels and abuse of dominance matters) to obtaining merger approvals.

See Ting is ranked among others in Chambers and The Legal 500 Asia Pacific in both Corporate/M&A and Competition, in IFLR in the area of Capital Markets (Equity) and in Asialaw and Who’s Who Legal for the area of Competition law.

She is a non-practising Barrister from Lincoln’s Inn, United Kingdom and an Advocate & Solicitor of the High Court of Malaya. She also holds a Masters of Art in EU Competition Law from King’s College London.

Linnet Lee, CFPCERT TM, IFP®

Chief Executive Officer,

Resolute Planning

Prior to Resolute Planning Sdn Bhd, she was the Chief Executive Officer of Financial Planning Association of Malaysia (FPAM). She also develops and runs financial literacy programmes for employees and the public.

Among her contributions to the industry include www.SmartFinance.my, a CMDF funded public financial education website with independent financial lessons and access to real Licensed Financial Planners in 2018. She also led the harmonisation of financial planning professional standards for Licensed Financial Planners which were adopted by the industry and accepted by the SC in 2021. Currently, she is working on the CMDF financial planning firms operating standards which are being finalised for industry adoption. All these initiatives are led by FPAM in collaboration with AFA, MFPC and MFPAA for the financial planning industry under the Securities Commission Joint Action Plan.

She sits on the Board of Studies & Exams of Social Wellbeing Research Centre, University Malaya and believes that financial planning and financial literacy are synergistically related towards strengthening the industry and people’s financial life as part of nation building.

Professor Joseph Cherian

Practice Professor,

Finance Asia School of Business

Joseph Cherian is Practice Professor of Finance at the Asia School of Business and at the Samuel Curtis Johnson Graduate School of Management at the SC Johnson College of Business, Cornell University (Visiting). He was most recently a Practice Professor of Finance and the Founding Director of the former Centre for Asset Management Research & Investments (CAMRI) at the National University of Singapore (NUS) Business School.

Prior to NUS, Joe was Managing Director, Global Head and CIO of the Quantitative Strategies Group at Credit Suisse in New York where he had direct responsibility for over US$67 billion in client assets managed to a quantitative discipline. While at Credit Suisse, he served on the Global Executive Committee, as well as various senior management, investments, and risk committees of the Asset Management division. He joined the financial industry in New York after an academic career in the US, including as an Associate Professor of Finance at Boston University.

He was formerly an Executive-in-Residence and a two-term member of the Johnson Graduate School of Management’s Dean’s Advisory Council at Cornell University and is now an Emeritus Member of the Dean’s Council. Joe currently serves as an Advisor to Asia Asset Management in Hong Kong, the Mercer-CFA Institute Global Pensions Index’s Advisory Board in Australia, and is a member of the Board of the Institute for Capital Market Research, an initiative by the Securities Commission Malaysia. He has had appointments at Singapore’s Central Provident Fund (CPF) Advisory Panel and the National Research Foundation’s Early-Stage Venture Fund Evaluation Panel.

Joe was an Independent Non-Executive Director of Bursa Malaysia in Kuala Lumpur, a Scientific Advisor to Nipun Capital, a boutique hedge fund based in San Francisco, Xen Capital, a boutique digital wealth and alternatives asset manager in Singapore, a consultant to Fullerton Fund Management, a Temasek subsidiary in Singapore, Singapore Exchange (SGX), and on the Journal of Alternative Investments’ Editorial Board in the US. Joe holds a B.Sc. in Electrical Engineering from MIT, and M.Sc. and Ph.D. degrees in Finance from Cornell University.

Yap Siok Hoon

Chief Executive Officer,

Eastspring Investments Malaysia

Yap Siok Hoon is the Chief Executive Officer for Eastspring Investments Malaysia. Siok Hoon joined Eastspring Investments Berhad (“Eastspring”) in November 2013 as Chief Sales & Marketing, responsible for the development and execution of Eastspring’s distribution, product and marketing strategies. Siok Hoon brings with her 26 years of financial industry experience, including 11 years at Eastspring covering retail and institutional business development, sales and marketing, distribution channel development, training and product development.

Prior to joining Eastspring, Siok Hoon was head of the retail client solutions & services group of a well established fund management company in Malaysia, overseeing the management company’s retail unit trust business. She started her career with Hong Leong Asset Management (HLAM) in April 1997 and has held many senior management positions, ultimately rising to a position of general manager, client solutions group in 2011.

Siok Hoon holds a Bachelor (First Class Honours) in Business Administration degree from Universiti Utara Malaysia.

Rajen Devadason

CFP Licensed Financial Planner

Rajen Devadason is a senior Malaysian financial planner, author, and professional speaker. He is a Certified Financial Planner (CFP), a Securities Commission-licensed financial planner with Manulife Investment Management (M) Berhad, and CEO of both general consultancy RD WealthCreation Sdn Bhd and sole proprietorship RD Book Projects. He has been interviewed repeatedly on BFM Radio in Malaysia, along with other TV and print media, on holistic financial planning and his professional specialty, retirement planning and funding. Rajen has also been asked to moderate and chair panel discussions on financial and retirement planning. He is often invited back by event organizers because of his engaging style that sets panel members and audiences at ease. Rajen’s targeted questioning skills were largely honed during his earlier career as an award-winning business journalist.

Rajen has written or co-written 10 books. He currently writes the weekly financial planning column for the New Sunday Times. For many years, he has also written the Christian financial planning column for Asian Beacon magazine and its online platform. Rajen’s one-on-one professional services are sought after by English-speaking business owners, professionals, and executives who wish to wisely prepare for retirement through domestic and global diversification, and to attain other major financial goals such as funding their children’s tertiary education, succeeding at general wealth accumulation, and, for seriously ambitious individuals, attaining Financial Freedom.

Rajen’s burning mission in life is to help high achievers take better care of their time, money, talent, and other resources, to help them regain a sense of firm control over their lives.

As CEO of RD WealthCreation and RD Book Projects, Rajen’s work involves consultancy, writing, and professional speaking. He graduated in 1988 with an honours degree in Physics and Computing from King’s College, University of London. He has lived and worked in the US, the UK, and Singapore, and now makes his home in sunny, peaceful Malaysia.

Between 1990 and 1994, Rajen was a journalist with Malaysian Business magazine, where he won both local and international awards for incisive business journalism. As the Malaysian winner of the Citibank Pan-Asia Business Journalism Award, he joined an elite team of other national winners from countries across Asia and Latin America for an extended 1994 two-week study trip to New York’s Columbia University, with working visits to the World Bank, the New York Federal Reserve Bank, and Bill Clinton’s White House.

Ch’ng Cheng Siew

Chief Investment Officer,

Areca Capital Sdn Bhd

Ch’ng Cheng Siew joined Areca Capital Sdn Bhd in August 2024 as the Chief Investment Officer (Equity), bringing nearly 26 years of experience across audit, corporate finance, and fund management. With a proven track record of success, she has consistently demonstrated her ability to drive performance and deliver value across a range of investment strategies.

Before joining Areca, Cheng Siew served as the Deputy CIO at Phillip Capital, where she played a pivotal role in managing private mandates, overseeing all unit trust funds, and leading tactical asset allocation strategies.

Earlier in her career, Cheng Siew held the position of Senior Fund Manager (Assistant Director) at Eastspring Investments Berhad, where she managed Asia Pacific ex-Japan unit trust funds and private mandates. Her extensive experience spans equity and mixed asset classes, with a particular focus on navigating complex markets and identifying high-potential investment opportunities.

Throughout her career, Cheng Siew has been recognized for her exceptional investment management capabilities, earning multiple Lipper Fund Awards for outstanding 3-Year and 10-Year performance across various categories, including Areca Capital’s flagship fund, Areca Equity Trust Fund.

She is also a chartered accountant of MIA and a CPA Australia qualified professional. She holds a Bachelor of Commerce from the University of Melbourne.

Balqais Yusoff

Head, Policy and Strategy Department,

Employees Provident Fund

Balqais Yusoff is currently heading the Policy and Strategy Department of the Employees Provident Fund (EPF). She is passionate in driving positive changes to social protection landscape in Malaysia. Prior to joining EPF, she led the Corporate Planning outfit of a public listed supply chain organization. She holds a Masters of Business Administration degree from Durham University, United Kingdom and a Bachelor’s of Arts degree in International Relations and Economics from University of Wisconsin, United States of America. Balqais has more than 20 years of experience spanning various industries such as banking, supply chain, public services and consultancy.

Mohd Ridzal Sheriff

Chairman,

Federation of Investment Managers Malaysia (FIMM)

Mohd Ridzal Mohd Sheriff (“Mohd Ridzal”) is currently the Chairman for Federation of Investment Managers Malaysia (FIMM) since 12 June 2019. He has been a public interest director of FIMM since 27 November 2017. On 13 August 2021, Mohd Ridzal has been appointed the Director General of Yayasan Pembangunan Ekonomi Islam Malaysia (YaPEIM). He is also the Chief Executive Officer (CEO) at InfinitoDAX (L) Pte. Ltd. His other previous roles include being the CEO of Infinity Blockchain Ventures, the Deputy Secretary General of the Malaysian Ministry of International Trade & Industry, as well as various roles in Deutsche Bank Malaysia Bhd and Bursa Malaysia. Aside from a distinguished professional career, Mohd Ridzal is also the Chairman of the Advisory Board of Charity Right Malaysia. Mohd Ridzal holds a Bachelor of Laws (Hons) degree from University of London and was a licensed stockbroker and financial derivatives trader.

Datuk Wira Ismitz Matthew De Alwis

Executive Director/

Chief Executive Officer,

Kenanga Investors Berhad

Datuk Wira Ismitz Matthew De Alwis (“Datuk Wira De Alwis”) is currently the Chief Executive Officer (“CEO”) and Executive Director of Kenanga Investors Berhad (“KIB”) and a member of its Investment Committee (“IC”). He also serves as a Non-Independent Non-Executive Director on the Board of Directors of Kenanga Islamic Investors Berhad, Eq8 Capital Sdn Bhd (formerly known as i-VCAP Management Sdn Bhd), as well as all subsidiaries of KIB.

As the CEO of KIB, he is responsible for the overall asset and wealth management business of KIB and its subsidiaries. He started his career as an Investment Analyst with a regional research and advisory firm, where he obtained vast regional exposure in Hong Kong, Philippines, Dubai and Singapore. He brings with him more than thirty (30) years’ worth of experience, expertise and several leadership roles in the fields of financial and investment management both regionally and locally. He joined KIB in June 2013 upon KIB’s acquisition of the ING investment management business in Malaysia, ING Funds Berhad, where he was the Executive Director and Country Head.

He is an alumnus of University of Cambridge, Judge Business School – ABSEP and has also attended the Advanced Business Management Program by the International Institute for Management Development, Lausanne, Switzerland. He holds an MBA and professional qualifications from the Chartered Institute of Marketing UK. He is also a Certified Financial Planner and Islamic Financial Planner. He has a Capital Markets Services Representative’s Licence from the Securities Commission Malaysia (“SC”) for fund management, investment advice and financial planning.

Datuk Wira De Alwis serves as the Chairperson of the Malaysian Association of Asset Managers, and is currently on the board of the Federation of Investment Managers Malaysia. He is also the Vice Chairman of the Institutional Investors Council Malaysia. He was appointed as a member of Bursa Malaysia’s Securities Market Consultative Panel (SMCP). He is also a member of the Joint Committee (BNM & SC) on Climate Change (JC3) and participates as a member of the Sustainable Investment Platform Steering Committee – Malaysia Sustainable Investment Initiative. Additionally, he holds the position of Investment Adviser for the Olympic Council of Malaysia’s Trust Management Committee.

He is a proponent of the industry’s talent development initiatives as a member of the Capital Market Graduate Programme Steering Committee (SC) and the Industry Competency Framework Advisory Panel for the Malaysian Capital Market project undertaken by the Securities Industry Development Corporation. He also sits on the SC’s Assessment Review Committee (ARC) – Fund Management.

Mohd Najman Md Isa

Chief Investment Officer,RHB Islamic International Asset Management Bhd

Najman joined RHBIIAM on 25 March 2024 after approximately 6 years with Sumitomo Mitsui DS Asset Management Hong Kong where he was the lead Equity Portfolio Manager for selected Asia ex-Japan equity mandates and also the lead Analyst for the financials sector of Emerging Asia ex-China markets. Prior to that, he was the lead Portfolio Manager for selected Shariah Asia Ex-Japan and Shariah ASEAN equity mandates at Eastspring Investments Malaysia for 2 years, after spending 5 formative years at Aberdeen Asset Management as a generalist for ASEAN equities and co-managing various Shariah equity mandates which helped to meaningfully grow their Islamic asset management business in Malaysia.

Before joining the Asset Management industry, Najman started his career as a Graduate engineer with UEM Builders Berhad in the Second Penang Bridge project. Najman holds a double degree in Civil Engineering and Commerce from the University of Melbourne. He is also a Chartered Financial Analyst (CFA) charterholder and a Capital Markets Services Representative’s License (CMSRL) holder for fund management.

Kaleon Leong

Chief Executive Officer,

Federation of Investment Managers Malaysia (FIMM)

Mr. Kaleon Leong bin Rahan is the Chief Executive Officer of the Federation of Investment Managers Malaysia (FIMM) effective 1 October 2018. He comes with over 20 years of experience in various senior management roles in the Malaysian investment management industry, specializing in the fields of unit trust and asset management, regulations and auditing.

Prior to his appointment at FIMM, Mr. Kaleon was the Chief Executive Officer and Director of HSBC (Malaysia) Trustee Berhad. He had also served at the Securities Commission Malaysia, AmInvestment Services Bhd, and PricewaterhouseCoopers.

In addition to the above, Mr. Kaleon has participated as a speaker and resource person on Fund Management in events organized by the Asian Development Bank, Securities Industry Development Corporation, etc. He is also a Board Member of the International Investment Funds Association (IIFA).

Mr. Kaleon is a Chartered Accountant (Malaysian Institute of Accountants) and holds a Bachelor of Accounting degree from the International Islamic University Malaysia, as well as a Masters Degree in Information Technology Management from University Tun Abdul Razak.

Long Shih Rome

Chief Economist,

Public Mutual Berhad

Mr. Long joined Public Mutual Bhd in June 2003. He is the Chief Economist for the company’s economics research team covering the key economies of the U.S., China, and Malaysia. He also presents thematic workshops and regular investment talks for the unit trust agents and corporate clients.

Prior to joining Public Mutual, Mr. Long was the managing editor of an established investment magazine and had written articles on stock market investments, unit trusts and economics. He started his financial career as an equity analyst with more than 10 years of experience covering the Malaysia and Singapore equity markets.

Mr. Long holds a Bachelor of Science Honours degree majoring in International Trade & Economic Development from the London School of Economics, London.

Muzzaffar Othman

Chief Executive Officer &

Executive Director,

Amanah Saham Nasional Berhad (ASNB)

Encik Muzzaffar Othman currently serve as Chief Executive Officer and Executive Director of ASNB. He holds Degree Bachelor of Science (Chemistry)and has served in several organizations before the current position in ASNB. He was in various sector including Manufacturing, Consulting, Aviation, Insurance and latest in Finance. Prior to his present position, he was the Chief Technology Officer in PNB and has been a member of the PNB Leadership Team since 2017.

He is a Capital Market Services Representative’s Licence holder. He also sits on the Board of FIMM, Goodyear Malaysia Berhad, GKN Driveline Malaysia Sdn Bhd, Raiz Malaysia Sdn Bhd, Jewel Digital Ventures Sdn Bhd and E-LOCK Corporation Sdn Bhd.

Peter Yong (Mr Money TV)

Founder of Finlit Media and Host for Mr Money TV

Peter Yong, is the founder of Finlit Media, a media start-up that focuses on transforming lives through edutainment content. Peter is also known as the host for Mr Money TV, the first financial channel in Malaysia, with more than 10 years experience as a financial planner/ advisor.

Through his creative storytelling process, he simplifies complex financial concepts into informative content that people can act upon. He has worked on multiple content marketing campaigns with different financial institutions internationally and locally such as MOF, KWSP, BSN, PNB, AHAM Capital, Prudential, etc, in improving the quality of life among Malaysians with financial literacy.

He holds a degree in psychology and business management. He is also a Registered Financial Planner (RFP) with Malaysian Financial Planning Council (MFPC).

Kuek Ser Kwang Zhe

Editor of Wealth,

The Edge

Kuek Ser Kwang Zhe is the editor of Wealth, a monthly pullout of The Edge that focuses on personal wealth and asset management stories. He has over ten years of experience writing about topics related to the fund management, financial technology (fintech) and digital asset industry, among others.

Reuben van Dijk

Director,

Melbourne Capital Group

Reuben van Dijk is a highly experienced professional in the wealth management and banking sector. He is currently a board member of Melbourne Capital Group, a company that specializes in providing bespoke financial solutions for high-net-worth individuals and families. Throughout 2024 the company has seen significant growth and success during its expansion into the ASEAN region.

Reuben has a deep understanding of the financial markets, and a keen eye for identifying opportunities for his clients. He holds an Associate Degree in Accounting from the University of Tasmania and a Diploma in Financial Services. His professional experience also includes institutional derivatives brokerage and commercial banking.

Melbourne Capital Group has expertise in structuring and implementing financial plans, including asset management, complex structures, holding companies, multinational commercial agreements, and financing agreements. They have a proven track record of delivering excellent results for their clients.

Reuben’s interests include traveling and reading. He believes that these activities provide unique perspectives on life and business and incorporates his experiences and learnings into his work at Melbourne Capital Group.